It’s not about software or services, or GRC vs. ERM. It’s about building risk-intelligent solutions that allow credit unions to make better decisions and prepare for uncertainty.

We get it: The noise can be deafening. Too many vendors, a roller coaster of regulatory changes, ever-changing world events—it’s tough to keep your focus while building a comprehensive risk program for your credit union.

Named for the English town where the idea behind the world’s first business cooperative was born in 1844, laying the foundation for how modern credit unions operate, Rochdale knows credit unions because that’s all we do. Serving this unique type of financial institution, and the people who work for it, takes a different skill set and perspective, and a strong desire to help others.

We’re much more than a powerful risk management platform; we serve as a trusted partner and consultant, ready to not only identify potential vulnerabilities but also help you pivot to stay ahead of what’s next.

If you’re ready to learn how to leverage risk to enable better decision-making, ensure sustainability and build paths to success, talk to us today.

Industry-Leading Tools & Expertise

Services

-

Enterprise Risk Management (ERM)

-

Vendor Risk Management (VM)

-

Risk Appetite

-

Strategic Planning

Software

- Enterprise Risk Management (ERM)

- Operational Risk Management (ORM)

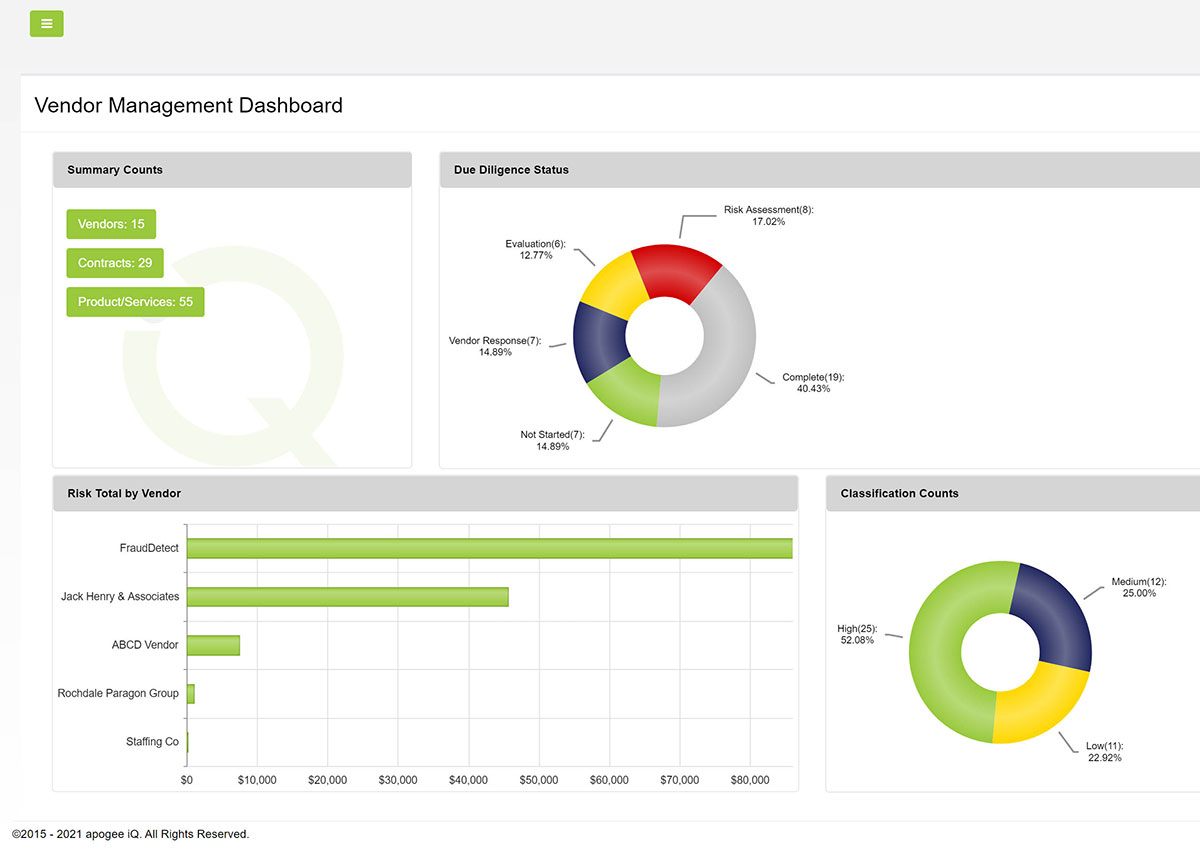

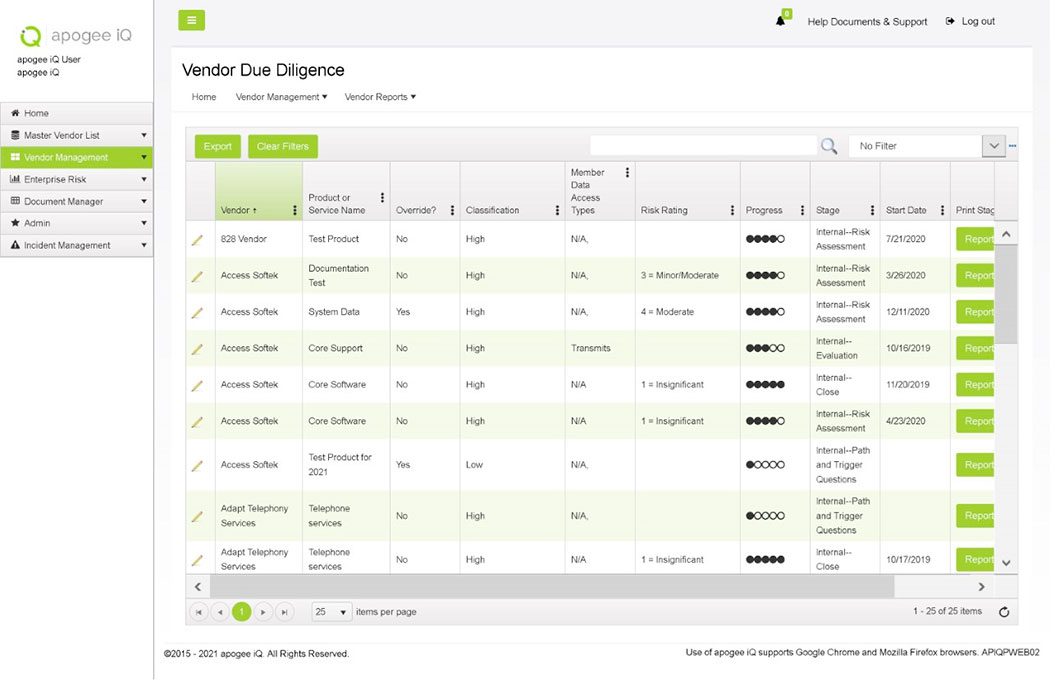

- Vendor Management (VM)

- Document Repository

Education

- VLI – Hawaii

-

CUNA ERM School

-

CUNA GAC

-

CUNA Compliance & Risk

-

Board/Management Training

-

Speaker’s Bureau

See Risk as an Opportunity Rather Than a Roadblock

– Tony Ferris, CEO & GRC Revolutionist

Risk management software infused with decades of industry knowledge

Our industry-leading risk management platform, apogee iQTM, helps you manage the risks specific to credit union strategy, operations and third-party partners by integrating ERM processes and strategy with other critical functions like vendor management and regulatory compliance.

Manage, leverage and optimize risk using apogee iQ, the most intelligent risk

management platform on the market.

Industry Involvement

As your partner in the credit union industry, we host, support and collaborate on several key industry events each year, including:

- VLI – HAWAII

- CUNA ERM CERTIFICATION SCHOOL

- CUNA COMPLIANCE & RISK COUNCIL CONFERENCE

- CUNA GOVERNMENTAL AFFAIRS CONFERENCE (GAC)

- BOARD/MANAGEMENT TRAINING

- AND MANY OTHER SPEAKING EVENTS